What to Expect From the Home Buying Process

Key Takeaways:

- Learn the essential steps in purchasing a home, from initial research to closing the deal.

- Understand the role of financial preparation and its impact on securing a mortgage.

- Explore effectively working with a real estate agent and navigating property showings.

- Gain insight into the importance of home inspections and negotiating offers.

Introduction

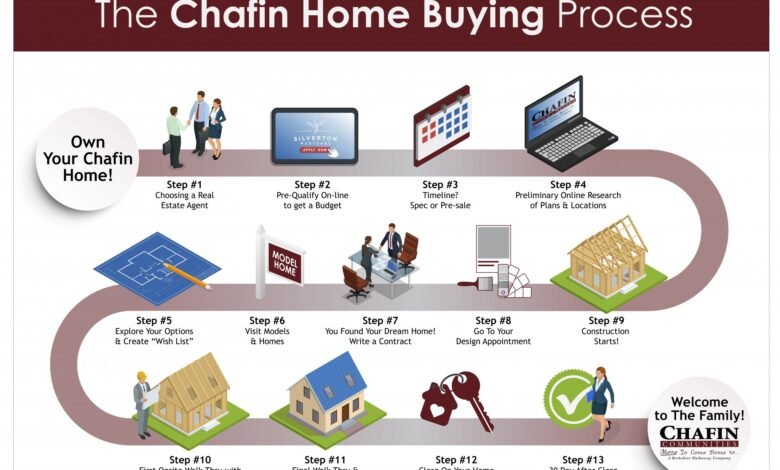

The journey to owning a home is an exciting milestone but can also be complex and overwhelming if you’re unprepared. Understanding your finances, closing the sale, and moving in are just a few of the many milestones in the process. For those new to home buying, enlisting the help of professionals like Los Gatos real estate experts The Oldham Group can streamline this undertaking. Their guidance can be invaluable, particularly in competitive markets where timing and negotiation skills are crucial. With their support, buyers can avoid common pitfalls and access listings that align closely with their goals. Ultimately, having the right team by your side transforms the experience into a smoother, more confident transition into homeownership.

Financial Preparation

Prior to going to open houses or looking through ads, you should organize your funds. Your credit score plays a significant role in determining the mortgage rates you’ll qualify for. Review your credit report, and take steps to improve your score if necessary. Reducing debt and saving for a down payment can significantly enhance purchasing power. Typically, lenders look for a down payment of 20%, but programs offer lower down payments for those who qualify.

Budgeting for home ownership should include more than just the mortgage. Consider property taxes, homeowner’s insurance, and potential maintenance costs as part of your budget. A detailed financial overview lets you set a realistic price range and avoid overstretching your finances.

Engaging a Real Estate Agent

Partnering with a skilled real estate agent can make the home-buying process smoother and more efficient. In order to help you search through listings and choose houses that fit your requirements, an agent offers market knowledge. They also facilitate showings, so you don’t have to schedule visits. An agent’s knowledge about specific neighborhoods, like school districts and future development plans, will assist you in making informed decisions about where to live.

Real estate agents also guide you through the offer and negotiation stages. They analyze comparable properties to suggest reasonable offers, advise on contingencies, and negotiate terms with sellers. In a competitive market, where making snap decisions could be the difference between winning a home and losing out to another buyer, their experience can be extremely helpful.

Property Showings and Evaluations

Viewing homes is one of the most exhilarating parts of the buying process. As you tour prospective homes, evaluate not just aesthetics but the property’s condition and potential costly repairs. Consider the layout, how it fits your lifestyle, and external factors like the neighborhood and commute times.

Don’t hesitate to ask questions during tours. Clarify any uncertainties about the state of the home, recent renovations, or community regulations. This is your opportunity to gather as much information as possible before making a crucial decision.

Home Inspections and Appraisals

After finding a potential home, scheduling a home inspection is critical. This assessment, conducted by a professional, helps identify any significant problems—such as issues with the roof, plumbing, or electrical systems—that could impact the home’s value or safety. Understanding these issues can inform your negotiations with the seller, whether you’re asking for repairs or a reduction in the asking price.

On the other hand, an appraisal determines the property’s market value and ensures that you’re not paying more than it’s worth. In order to safeguard their investment, lenders want an appraisal, which is crucial to completing your mortgage approval.

Closing the Deal

Once you’ve negotiated terms and secured financing, it’s time to finalize the purchase. The closing involves signing all necessary documentation, from the mortgage agreement to title insurance papers. It’s also when you’ll settle any remaining fees, such as closing costs, typically ranging from 2-5% of the loan amount.

Conduct a last tour prior to the final signing to ensure the property is in the agreed-upon condition. This stage guarantees that the house is prepared for your move-in and that any requested repairs have been finished.

Conclusion

Understanding the home-buying process can turn an overwhelming experience into an achievable goal. With adequate preparation and professional guidance, potential pitfalls can be easily navigated, leading to a successful purchase. Each step—from financial preparation and working with an agent to negotiating offers and closing—builds towards owning a home that meets your needs and lifestyle.